How to Use Stripe in Unsupported Countries (2025 Guide for Non-US Founders)

I may earn a commission from affiliate partner links featured here on my site. Such commissions allow me to maintain and improve this site. Read full Disclosure.

Stripe doesn’t officially support all countries, but you can still use it legally with the right setup. This 2025 guide reveals how founders from Africa, Asia, and other unsupported regions can establish a fully verified Stripe account by forming a U.S. LLC, obtaining an EIN, and linking a U.S. bank account.

Whether you are running an online store, a SaaS business, or a freelancing business, this works.

Contents

- 1 Countries Where Stripe Is Not Supported

- 2 Can You Use Stripe From An Unsupported Country?

- 3 Requirements To Use Stripe In Unsupported Countries

- 4 Step-by-Step: How To Use Stripe From Anywhere

- 5 The Cheapest States To Form An LLC

- 6 How To Form An LLC For Stripe

- 7 Open A Stripe Account Using Your LLC Details

- 8 Should I Buy A Stripe Account?

Countries Where Stripe Is Not Supported

When writing this blog post, Stripe is available in only 46 countries. If your country is not among the supported ones, you will need to find a legal and widely accepted method for using Stripe in an unsupported country.

Can You Use Stripe From An Unsupported Country?

Yes, it is possible to use Stripe if you are from an unsupported country. However, some requirements must be met.

Requirements To Use Stripe In Unsupported Countries

To use Stripe in unsupported countries, you need to form a US company, an LLC (Limited Liability Company). You will need an EIN (Employer Identification Number) or Tax ID, a US physical address, a US phone number, and a US bank Account.

Step-by-Step: How To Use Stripe From Anywhere

1. Form a US LLC

Forming an LLC will cost you some dollars. If you are to register your business name or company in your home country, you will spend money. It is the same thing with LLC formation.

If you are to register your LLC using a lawyer, you should be ready to cough out close to $1000. I will show you the cheapest and easiest way to form your LLC.

Let me explain a little about an LLC so you can know what you want to venture into and spend your money on.

An LLC is also known as a “limited liability company” or “limited liability partnership.”

An LLC is a business structure that allows you to operate as a limited liability company. This means that the owners of an LLC have limited legal responsibility for their actions and are protected from personal liability.

An LLC is a great option if you want to start your own business and keep your personal assets separate from your business assets.

Even though the main purpose of forming this LLC is to use it to open a Stripe account for unsupported countries, it has other benefits for your business.

2. Get an EIN (Employer Identification Number)

EIN stands for Employer Identification Number. It is a nine-digit number that you will use to identify your business.

This number is also like an SSN (social security number), and it is used by the Internal Revenue Service (IRS) to track the status of your business’s tax forms.

Do not get worried that you will have to start paying heavily in taxes. You can avoid paying taxes by filing your LLC in a tax-free state.

3. Get a US Physical Address

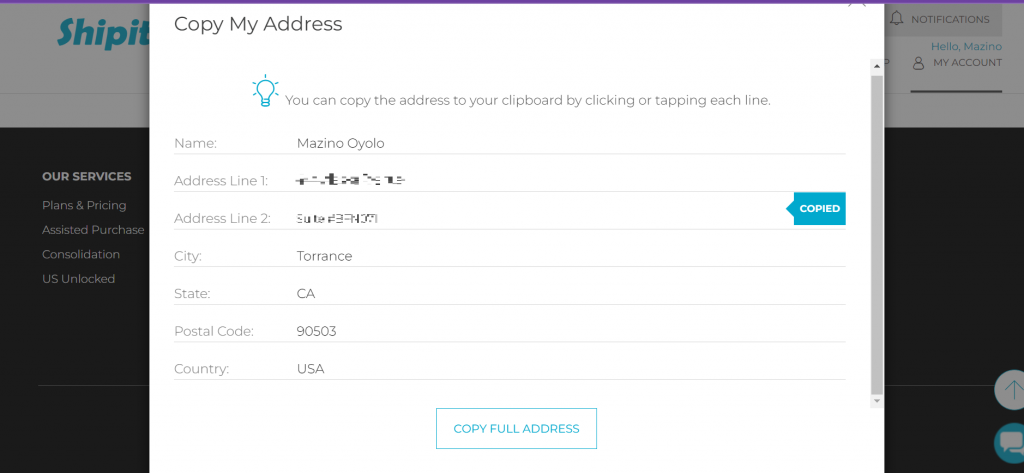

Go to Shipito.com and create a US address. You will likely get a California address. Take note that CA means California.

4. Get a US Phone Number

It is easy to get the phone number. Go to your app store and download dingtone. You can use dingtone to create a functional US phone number. Another option is Skype.

If you have created the US address and phone number, the next stage is to form your LLC.

5. Set Up a U.S. Bank Account

Go to Payoneer.com or wise.com and create an individual US bank account. It is needed during the stripe registration process – they will request a bank account. If your US bank account is available, then it is time to proceed to Stripe and set up your account.

Grey is another option to open a US bank account. The service is currently available to these countries: Algeria, Angola, Argentina, Austria, Belgium, Benin, Bulgaria, Cameroon, Canada, Chile, Colombia, Cote D’Ivoire, Croatia, Cyprus, Czechia, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Holy See (Vatican City State, Hungary, India, Indonesia, Ireland, Italy, Kenya, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Moldova (Republic of), Monaco, Morocco, Namibia, Netherlands, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Romania, Rwanda, San Marino, Saudi Arabia, Senegal, Singapore, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Tanzania (United Republic of), Thailand, Togo, Turkey, Togo, United Arab Emirates, United Kingdom, Uruguay, Vietnam, Zambia.

Geepay is another preferred option for opening a US bank account. The service is currently available to these countries: Egypt, Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, and Uganda.

With all of these explained and other requirements ready (US phone number and address), it is time to start your LLC registration.

The Cheapest States To Form An LLC

There are some states in the US where it is cheap to form an LLC and has no annual tax fee. If you are asking what the cheapest states are to form an LLC, here are a few with low state filing fees and annual tax fees.

- Kentucky

Filing fee: $40

Annual tax fee: $15 - Mississippi

Filing fee: $50

Annual tax fee: $0 - Missouri

Filing fee: $50

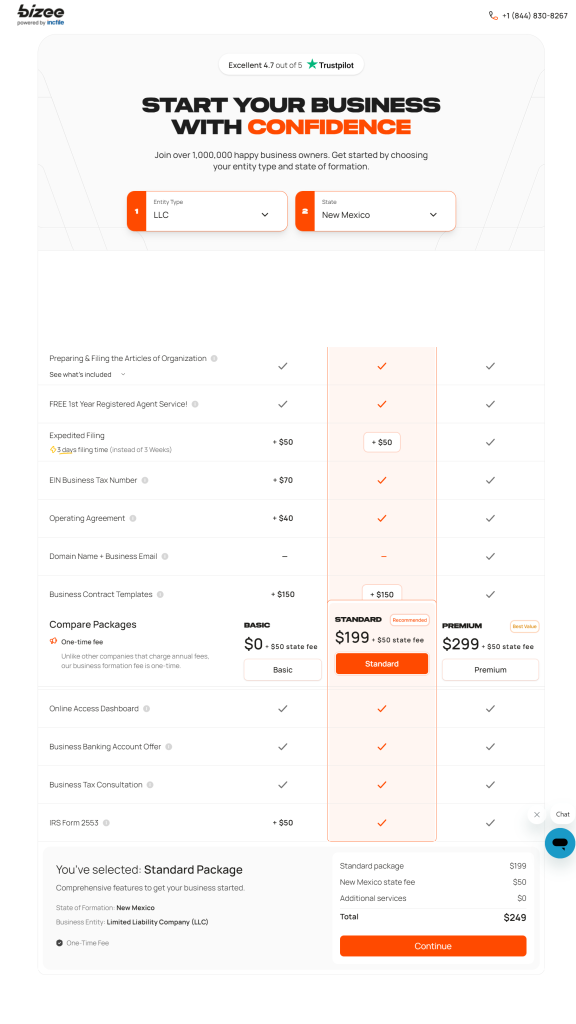

Annual tax fee: $0 - New Mexico

Filing fee: $50

Annual tax fee: $0 - Colorado

Filing fee: $50

Annual tax fee: $10

The state filing fee is the fee charged by the state to file a new business entity. The annual tax fee is a tax that you pay to the state government every year. The tax fees that you pay depend on the type of business you have. If you have an LLC, then your annual tax fee is based on the number of members and profits in your company.

The reason I took my time to explain all of these terms is for you to understand what you are paying for and why you are paying for it. They are required for LLC formation, whether you are doing it yourself or hiring someone to do it for you.

If you want to escape the annual tax fees, you should choose either of these states: Mississippi, Missouri, or New Mexico. Please know that things are meant to change over time, but at the time of publishing this post, the information above was accurate.

How To Form An LLC For Stripe

To form an LLC, you will need to use an LLC formation service. An LLC formation service is a company that helps you form an LLC (limited liability company).

Many people who want to form an LLC don’t have the time, resources, and knowledge to do it themselves. That is where the service comes in.

They will handle all the paperwork, including filing the articles of incorporation, which is necessary if you want to operate under this type of structure.

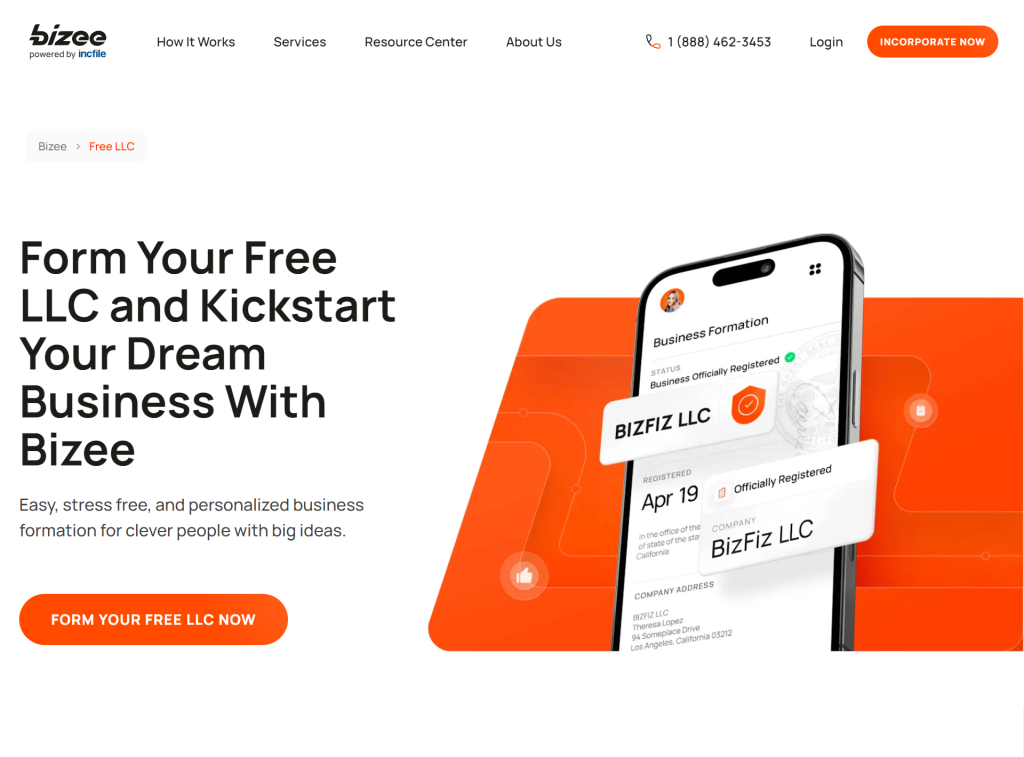

The best and cheapest LLC formation service provider out there that will help you with everything is Bizee, powered by Incfile. They offer free LLC formation. They won’t charge for their services, but you only pay the mandatory fee required to form the LLC.

Click here to visit the Bizee website to get started.

1. Click on form your free LLC now.

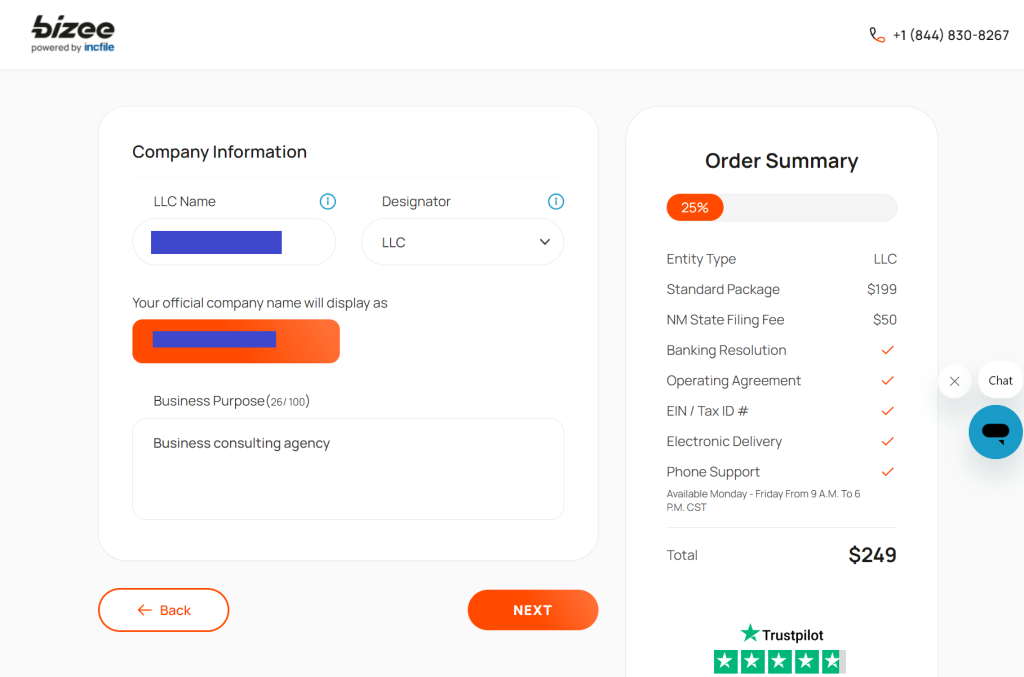

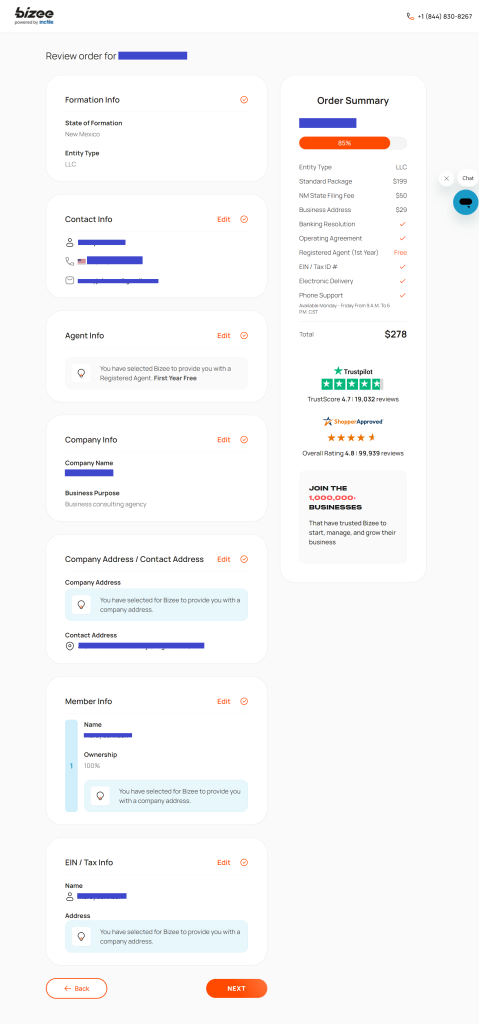

2. Select your entity, which should be LLC, and the state. Choose the Standard package.

3. Choose your LLC name and business purpose.

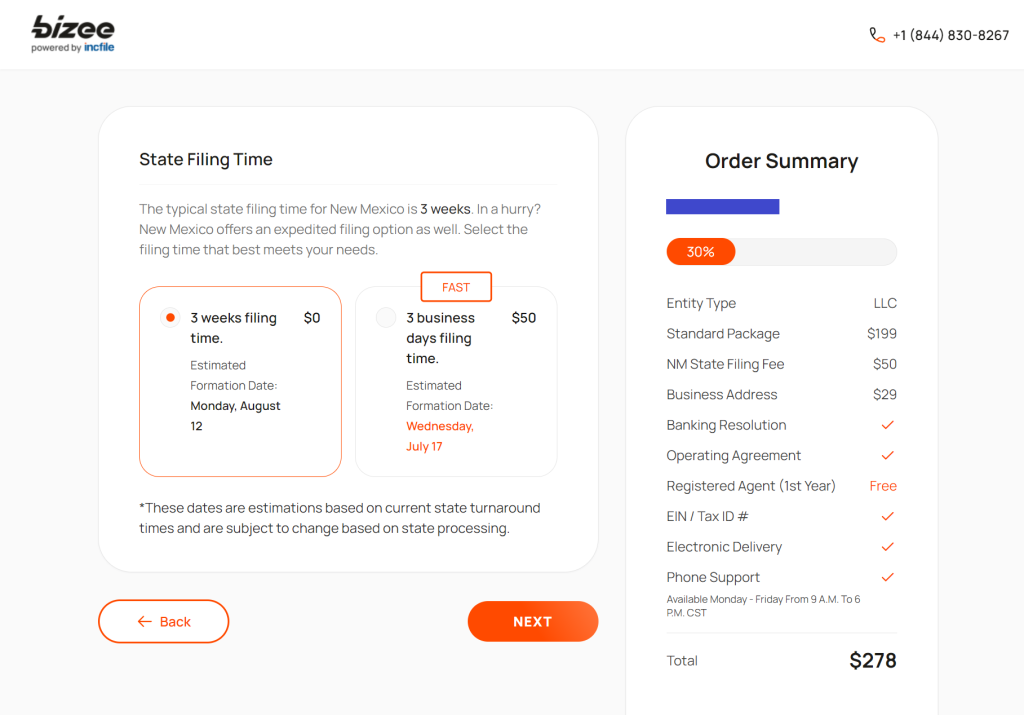

4. Choose the state filing time.

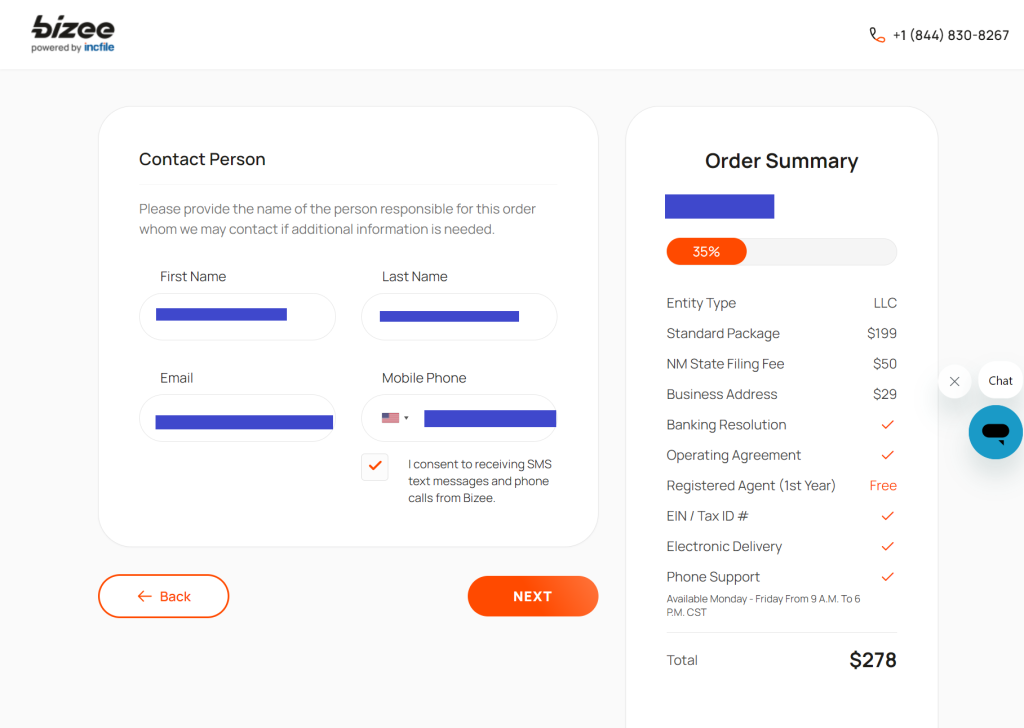

5. Fill in your name, email address, and US phone number.

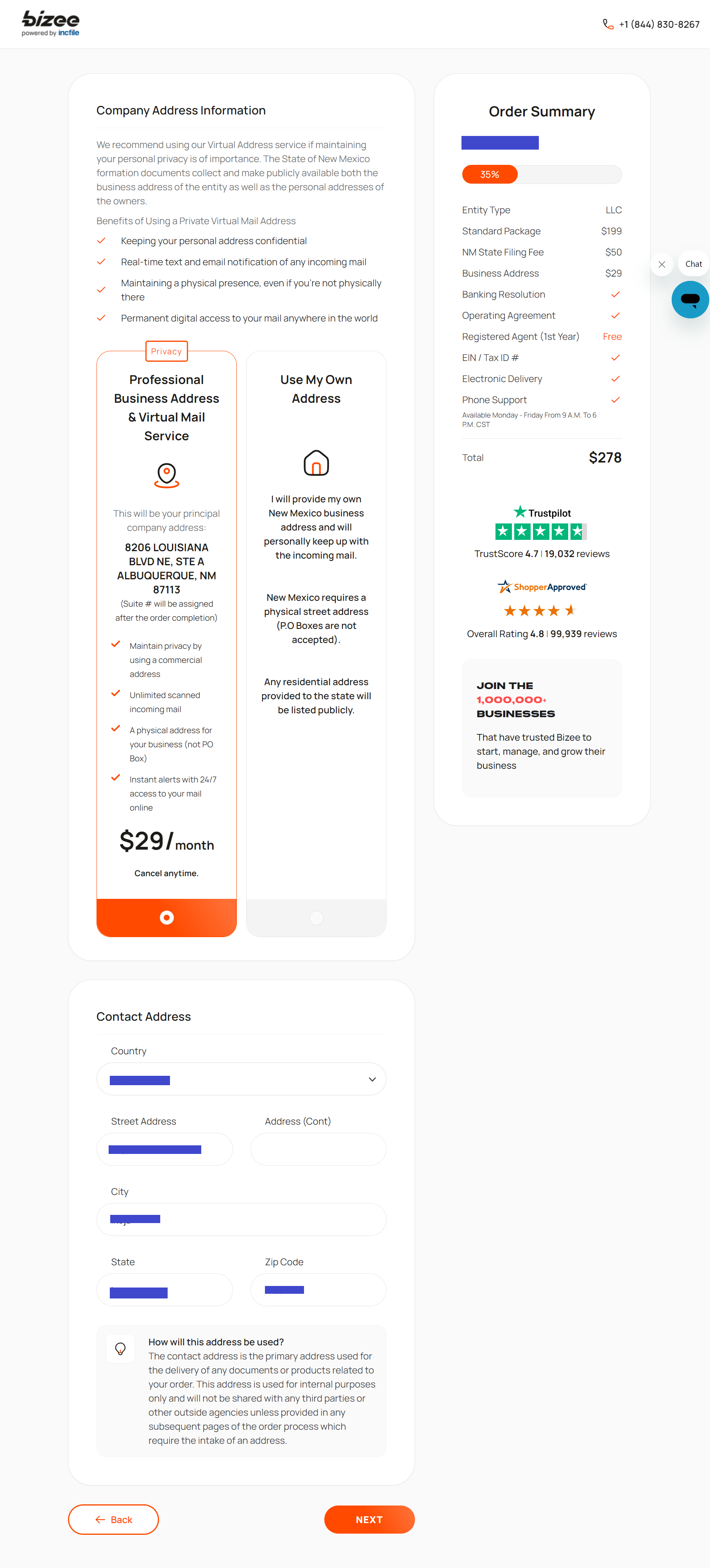

6. Add your company information and contact address. If you are a non-US resident, you can use your home country details for your contact address.

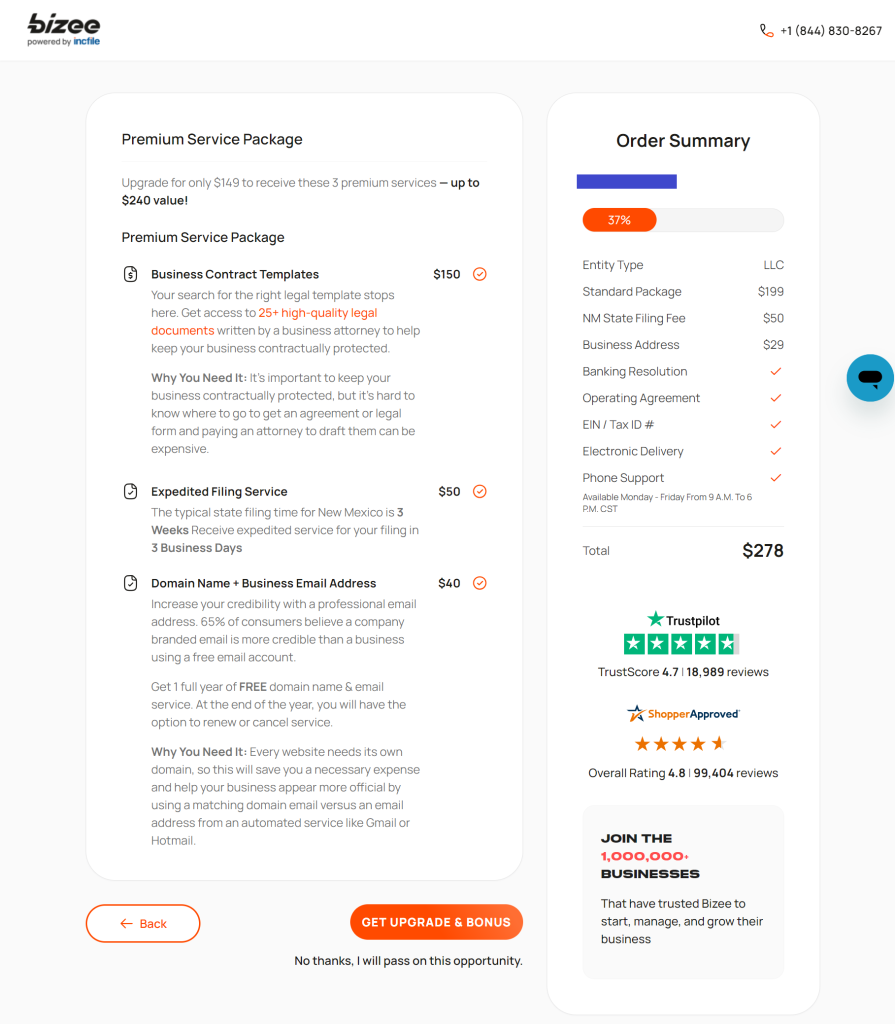

7. Skip the premium service package if you don’t need it.

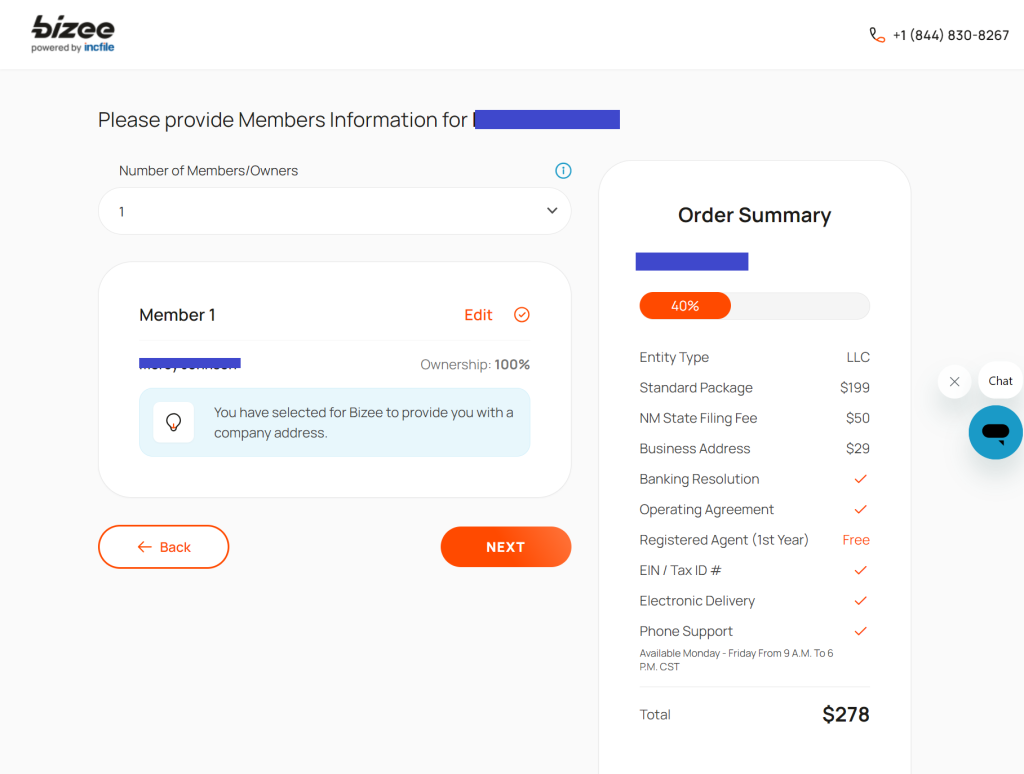

8. Choose an individual if your LLC member is a person or a business. (Choose a person).

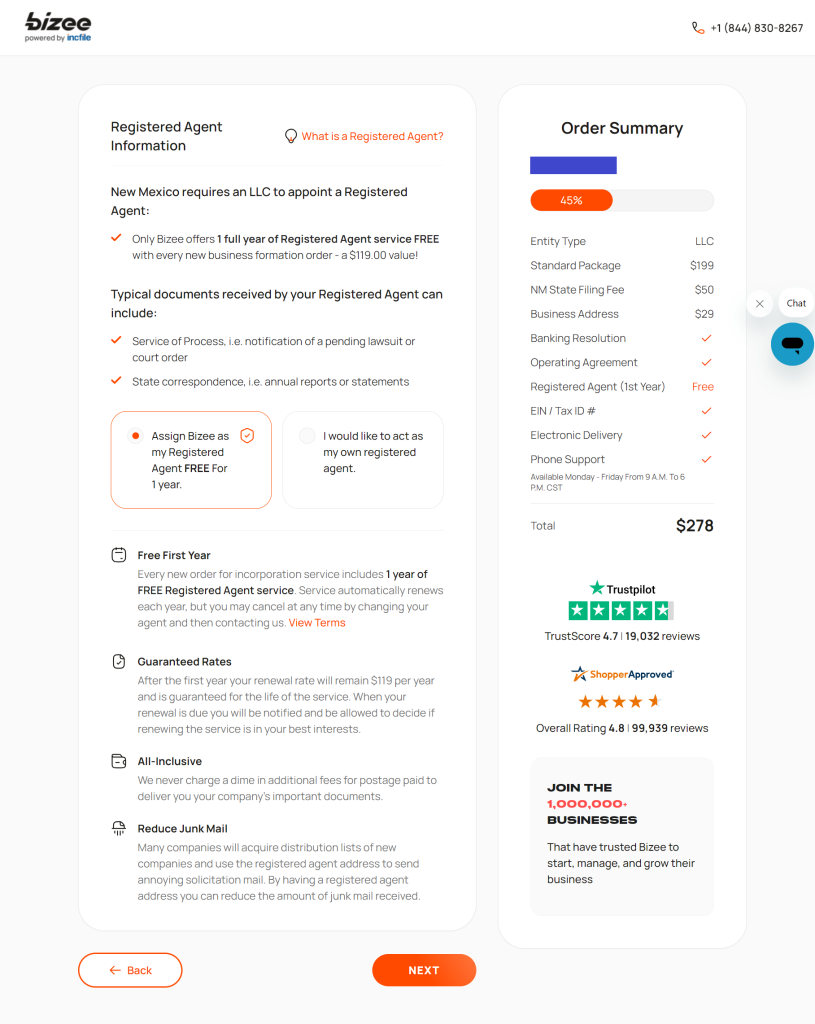

9. Assign Bizee as your registered agent.

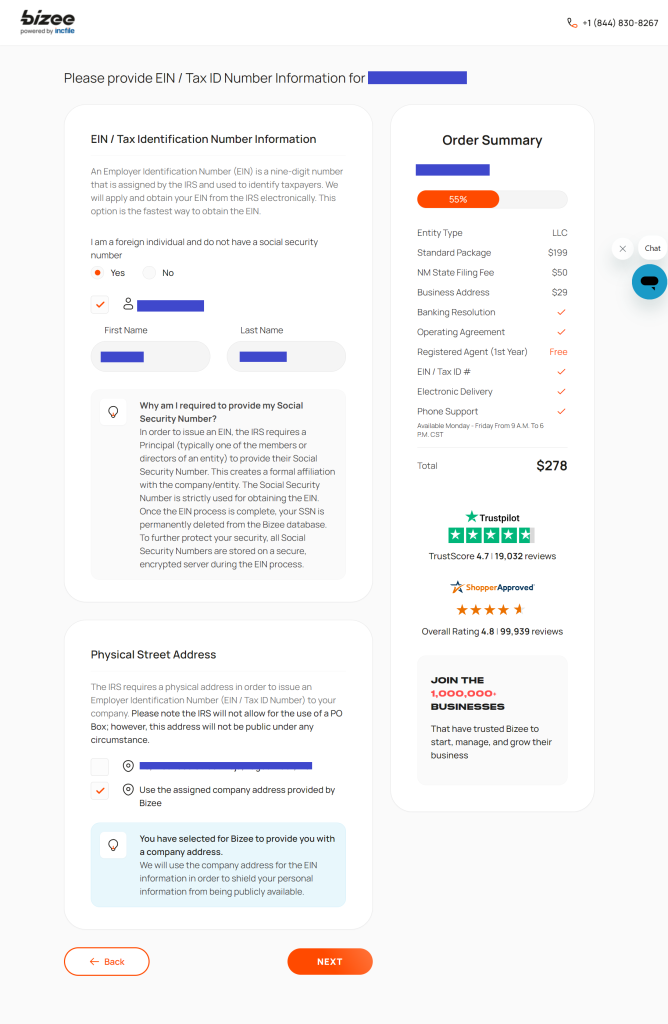

10. Indicate that you are a foreign individual and do not have a Social Security number.

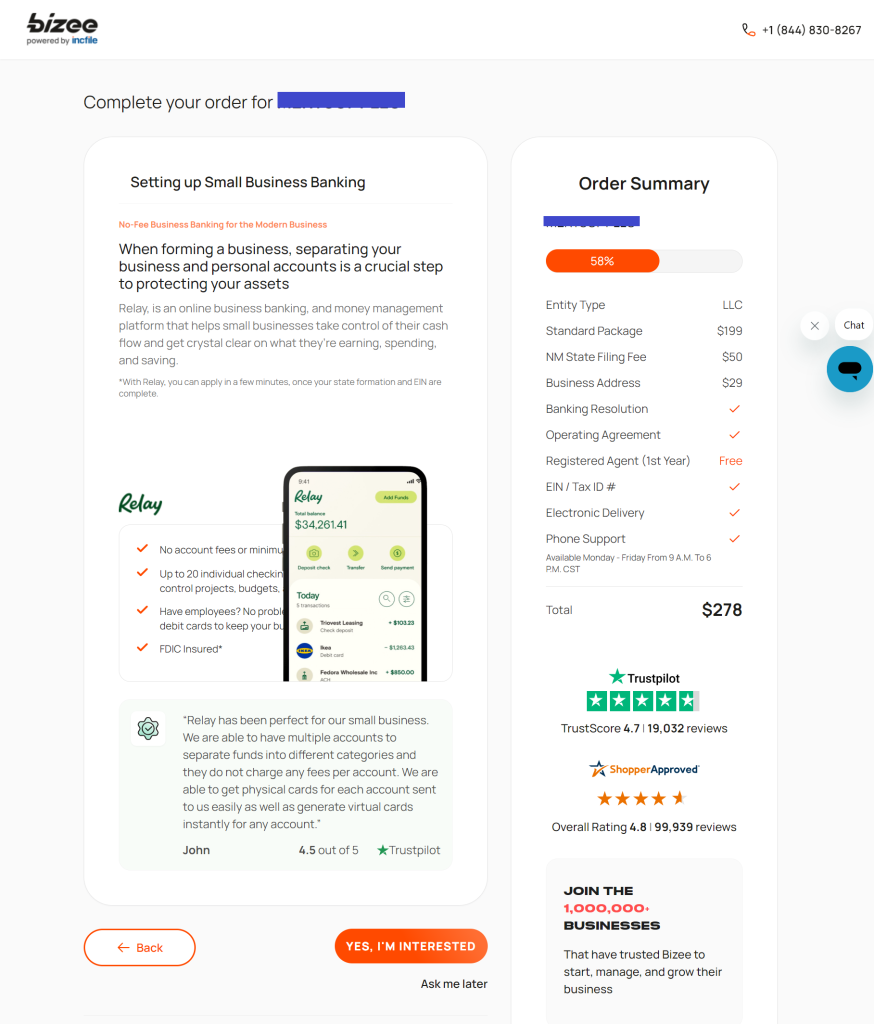

11. You can skip setting up small business banking.

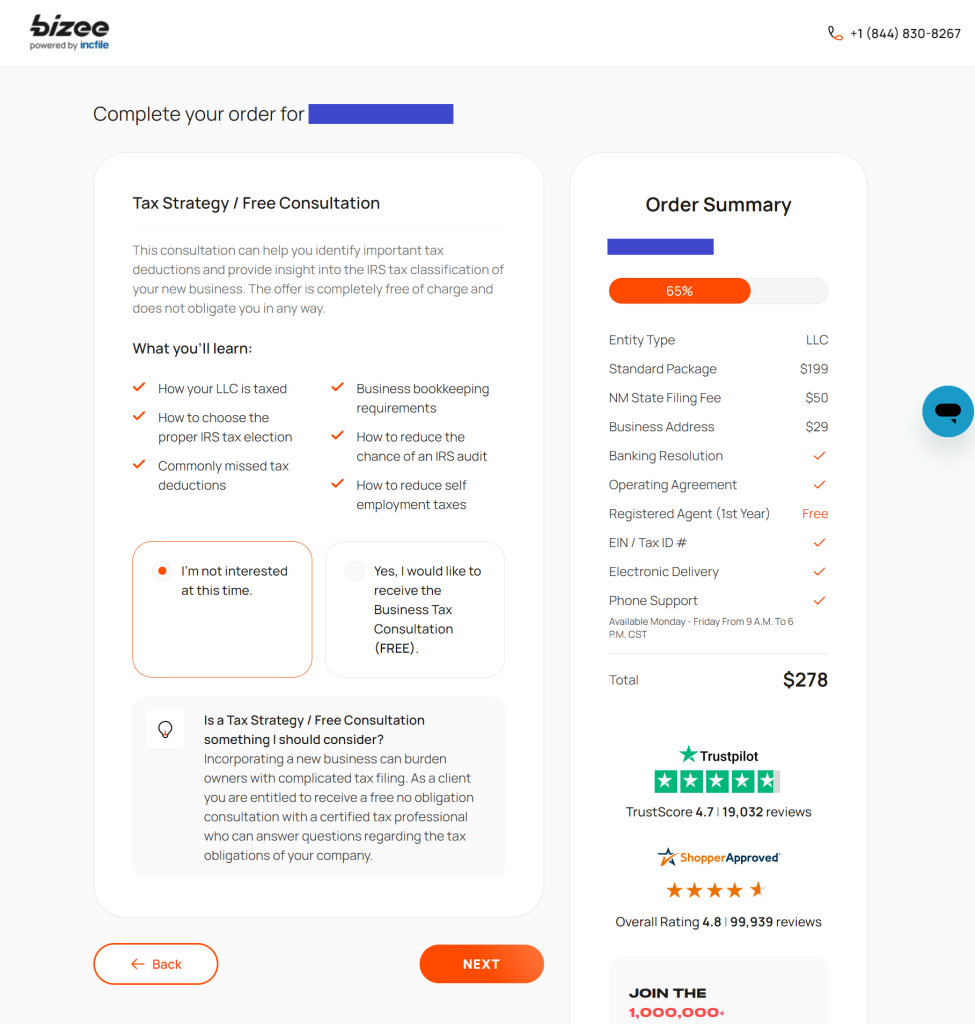

12. Skip the tax strategy/ free consultation if you don’t need it.

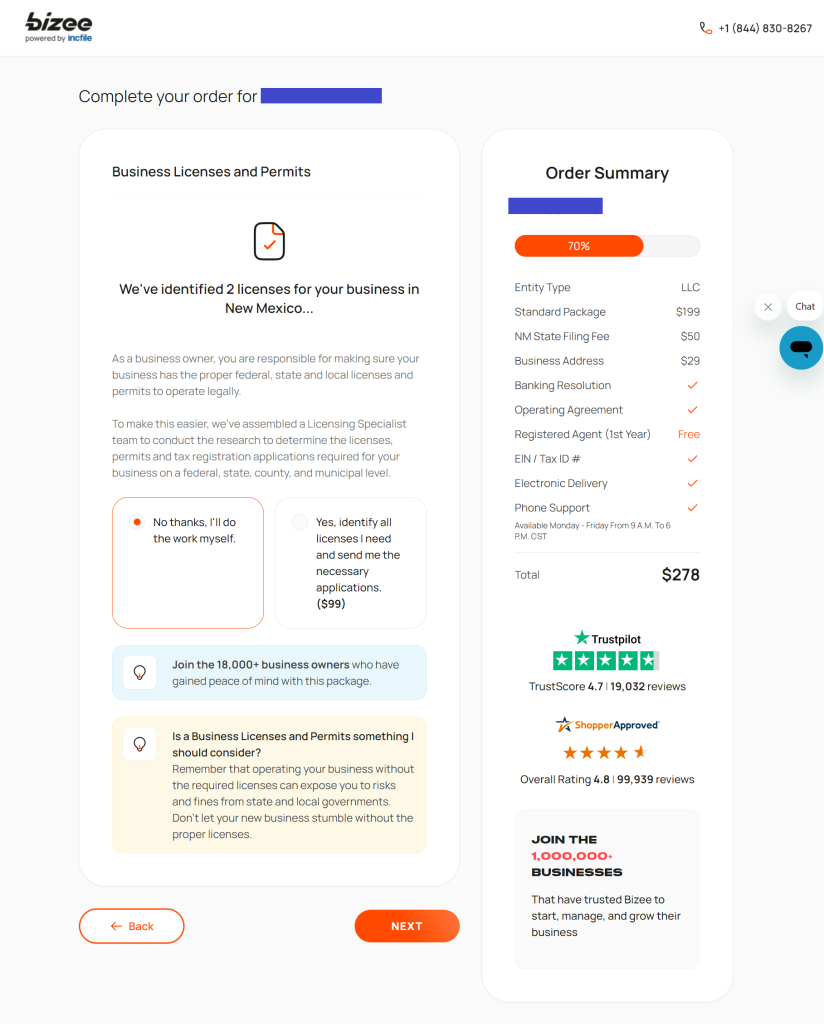

13. Skip business licenses and permits.

14. Review your order.

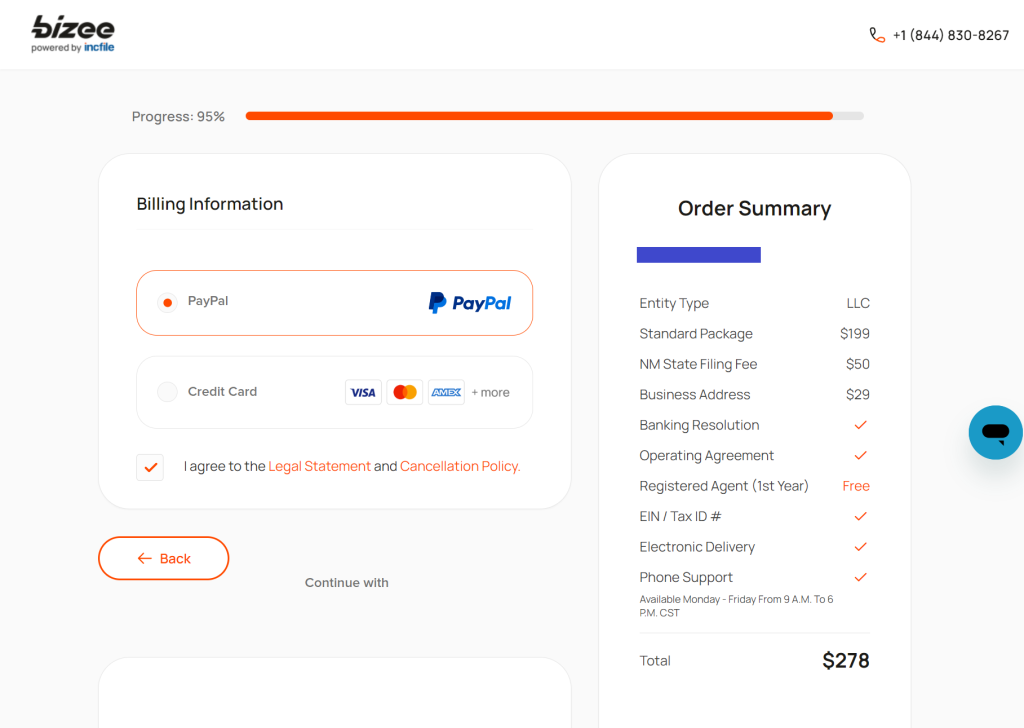

15. Complete your order using PayPal or a credit card.

If you want other LLC formation services, you can try Northwest Registered Agent and ZenBusiness.

With this, you are just a few steps away from opening a Stripe account as a non-US citizen. Your information will be processed, and in a few weeks, you will get your EIN, which will be needed for the Stripe account creation.

If you have gotten your EIN, congratulations again! You are a few steps away from opening a verified Stripe account in an unsupported country.

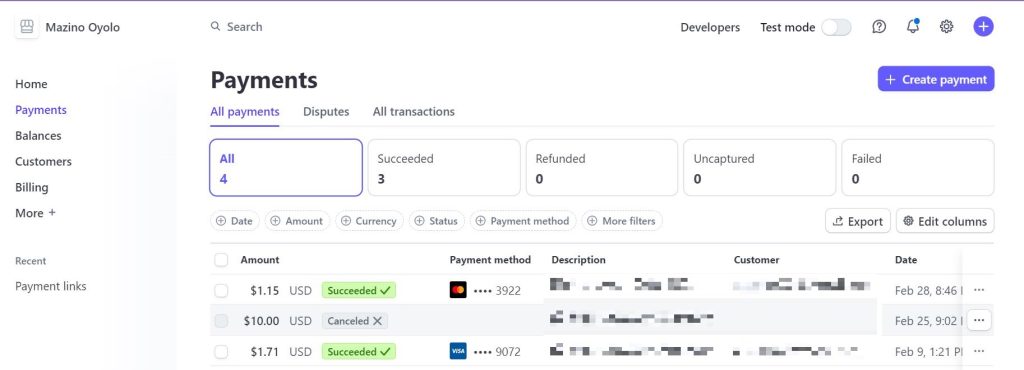

Open A Stripe Account Using Your LLC Details

It is assumed that at this stage, your LLC has been formed, and your EIN and registered agent details have been obtained. Now it is time to proceed to Stripe to set up your account.

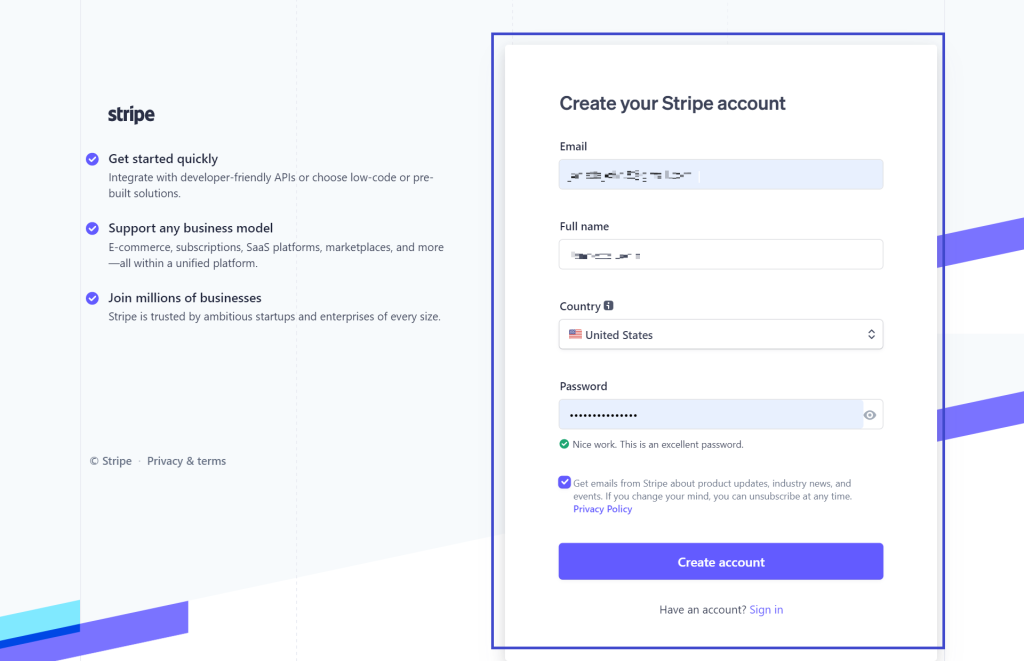

Step 1. Visit https://dashboard.stripe.com/register.

Enter your email, full name, and country (leave it in the United States). Enter your password and click Create Account.

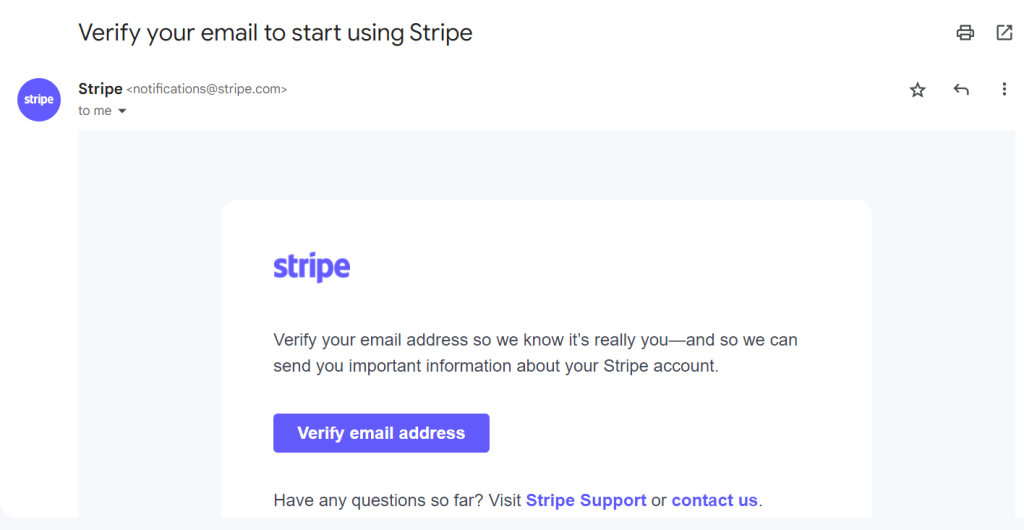

Step 2. Verify your email address.

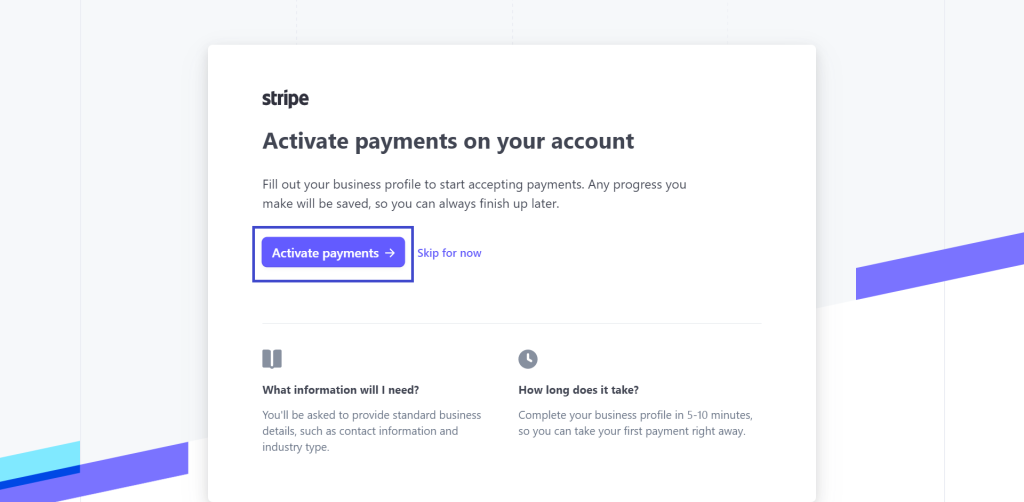

Step 3. Activate payments on your account. Click on Activate Payments to start the process of setting up your Stripe account.

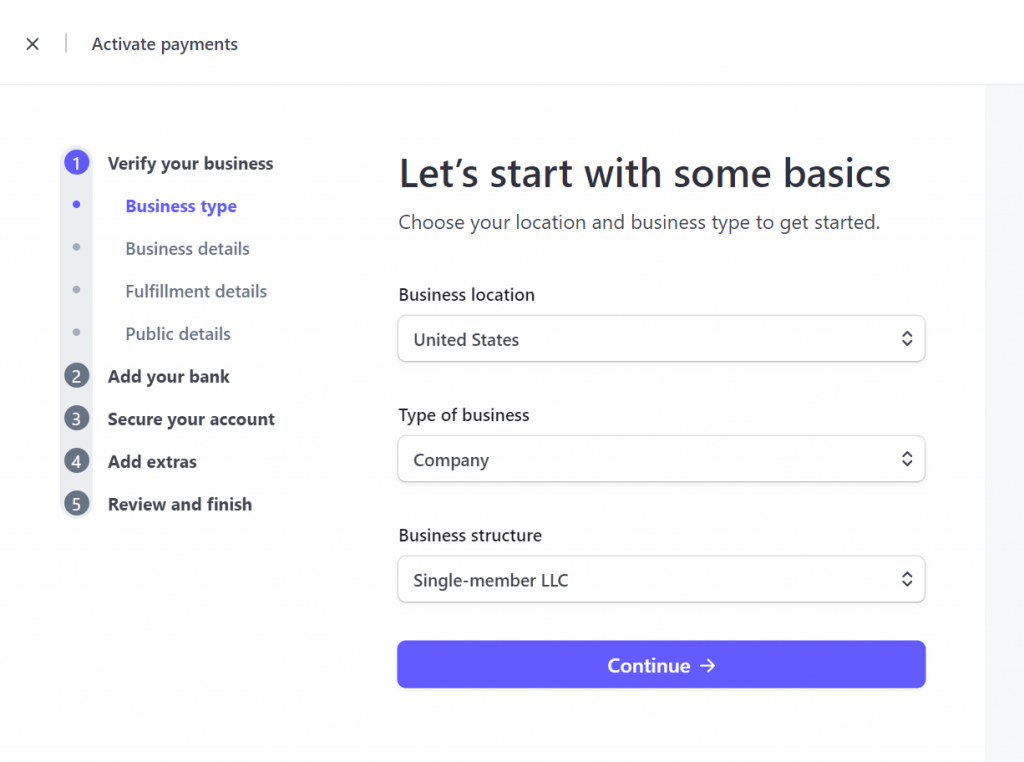

Step 4. Choose your business type. The business location should be the United States. The type of business should be a company and a single-member LLC business structure.

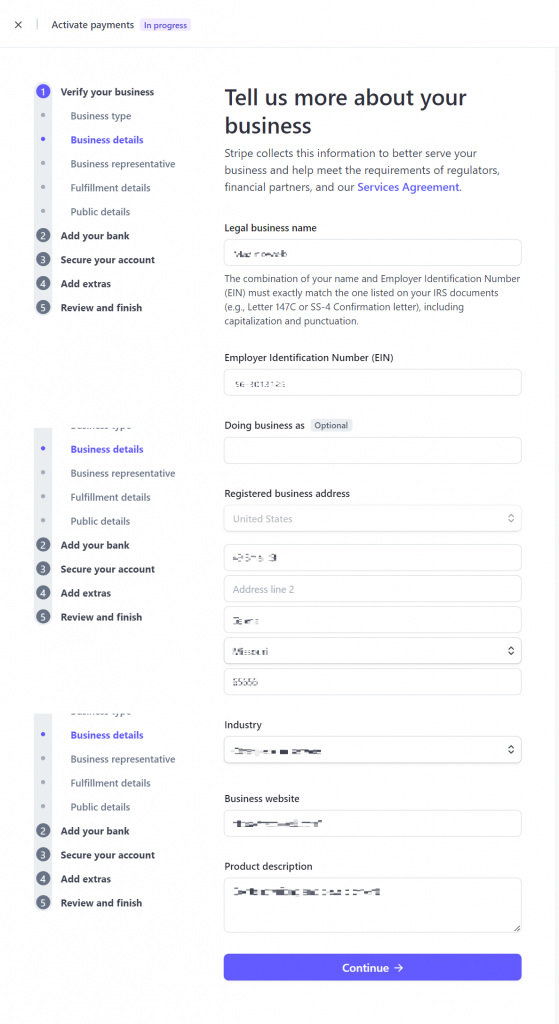

Step 5. Business details. Your legal business name should be the name of your LLC. Fill in the EIN obtained from Bizee. The registered business address should be the registered agent’s address from Bizee. Choose your industry, and enter your website URL and product description (business description). Click on continue.

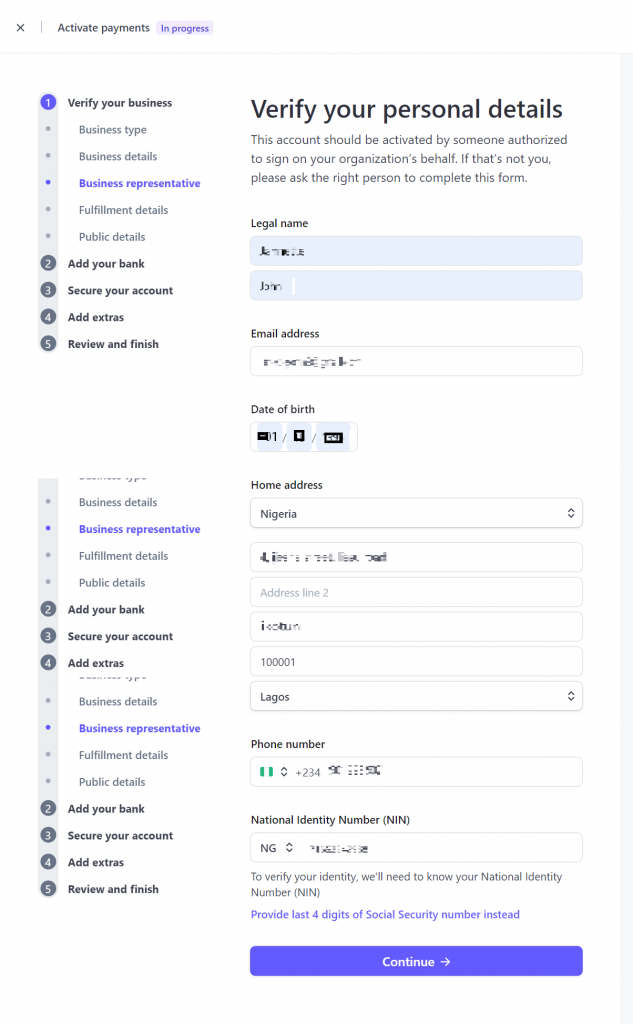

Step 6. Business representative. This part is for you to verify your personal details. Your legal name should be your real name. Your email address will automatically be displayed there. Enter your home address. You should use your home address and phone number (not a US phone number). Since you are a non-US citizen, you don’t have an SSN. So choose to provide a government-issued ID number instead.

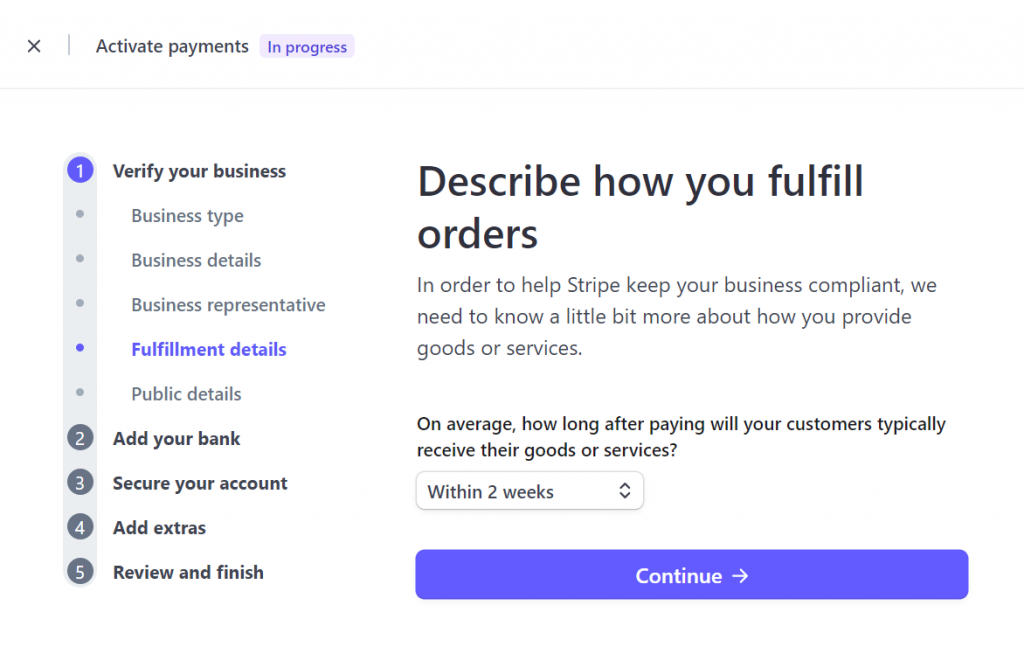

Step 7. Fulfilment details. This part is to let Stripe know how long it will take for you to deliver to customers the products or services that you are selling after they make payment.

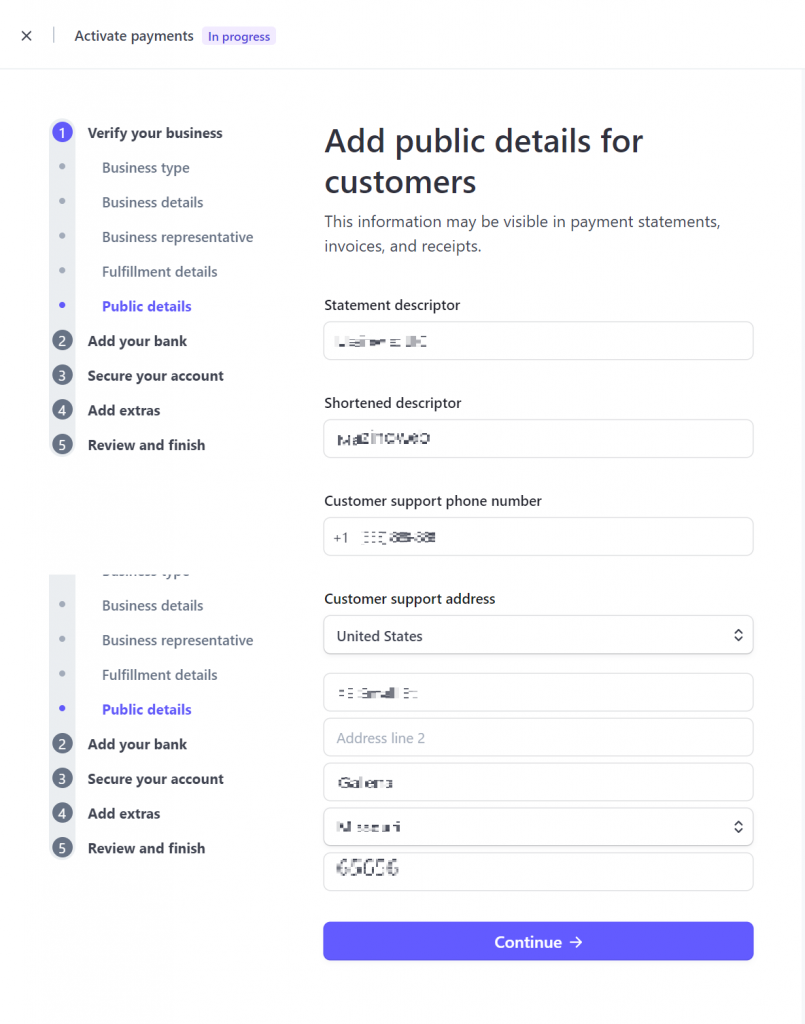

Step 8. Public details. This part is for you to decide what customers will see on their payment statements, invoices, and receipts. It is recommended that you enter your LLC in the statement descriptor (eg Mazicom LLC). In the shortened descriptor, you can add only the name of your business (eg Mazicom).

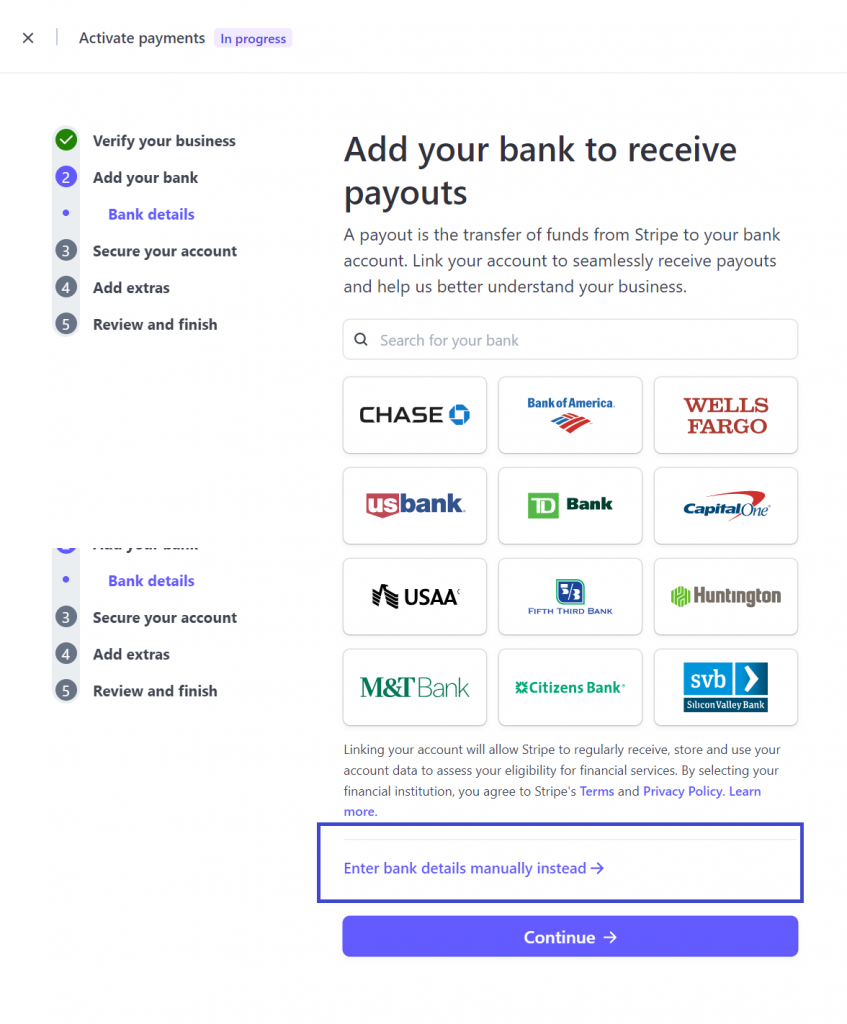

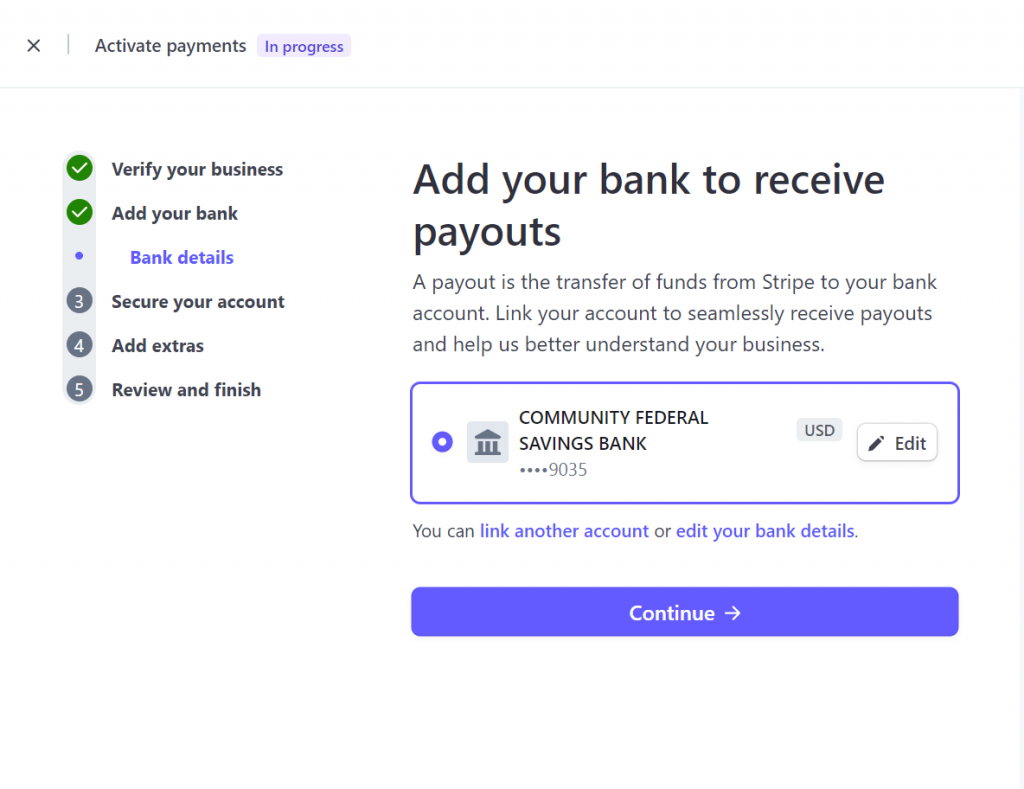

Step 9. Add your bank account to receive payouts. For you to be able to move your money out of Stripe, you must add a bank account. If your bank is not listed there, you need to enter it manually.

Step 9. Add your bank account to receive payouts. For you to be able to move your money out of Stripe, you must add a bank account. If your bank is not listed there, you need to enter it manually.

If you have a Payoneer account, you can go there and add the bank details. If you have any other US bank accounts from other financial institutions, you can try it too.

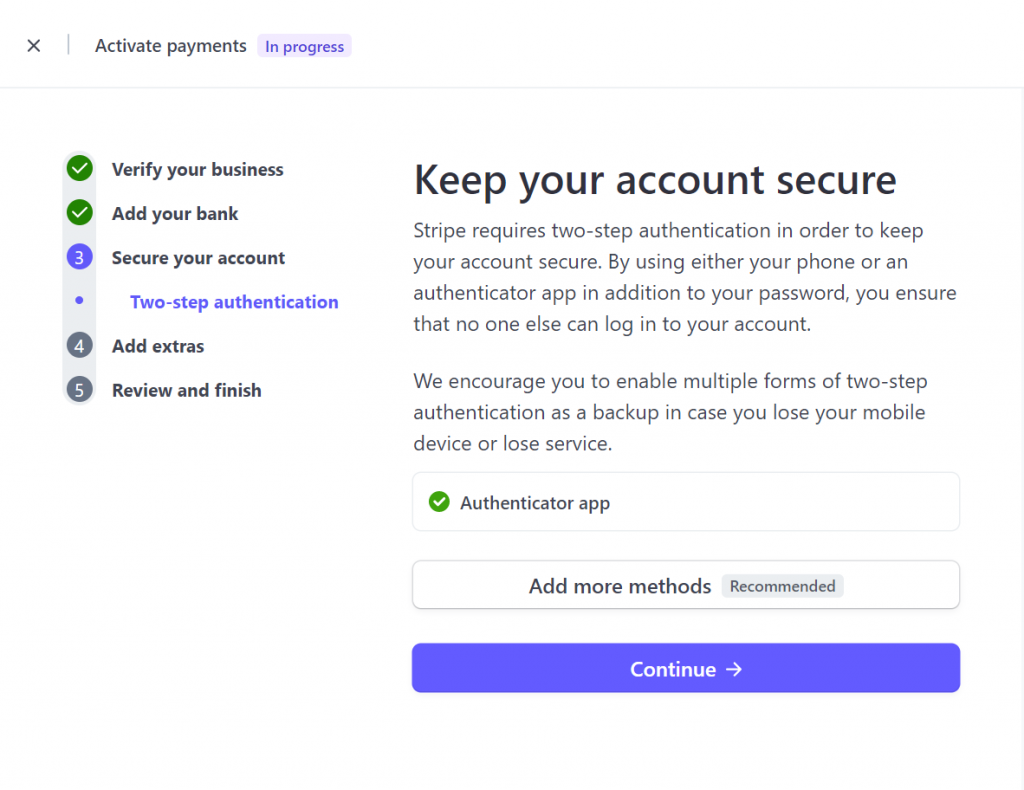

Step 10. Secure your account. You can use SMS or an authenticator app. With two-step authentication, no one else will be able to log in to your account. Once you are done, click continue.

Step 10. Secure your account. You can use SMS or an authenticator app. With two-step authentication, no one else will be able to log in to your account. Once you are done, click continue.

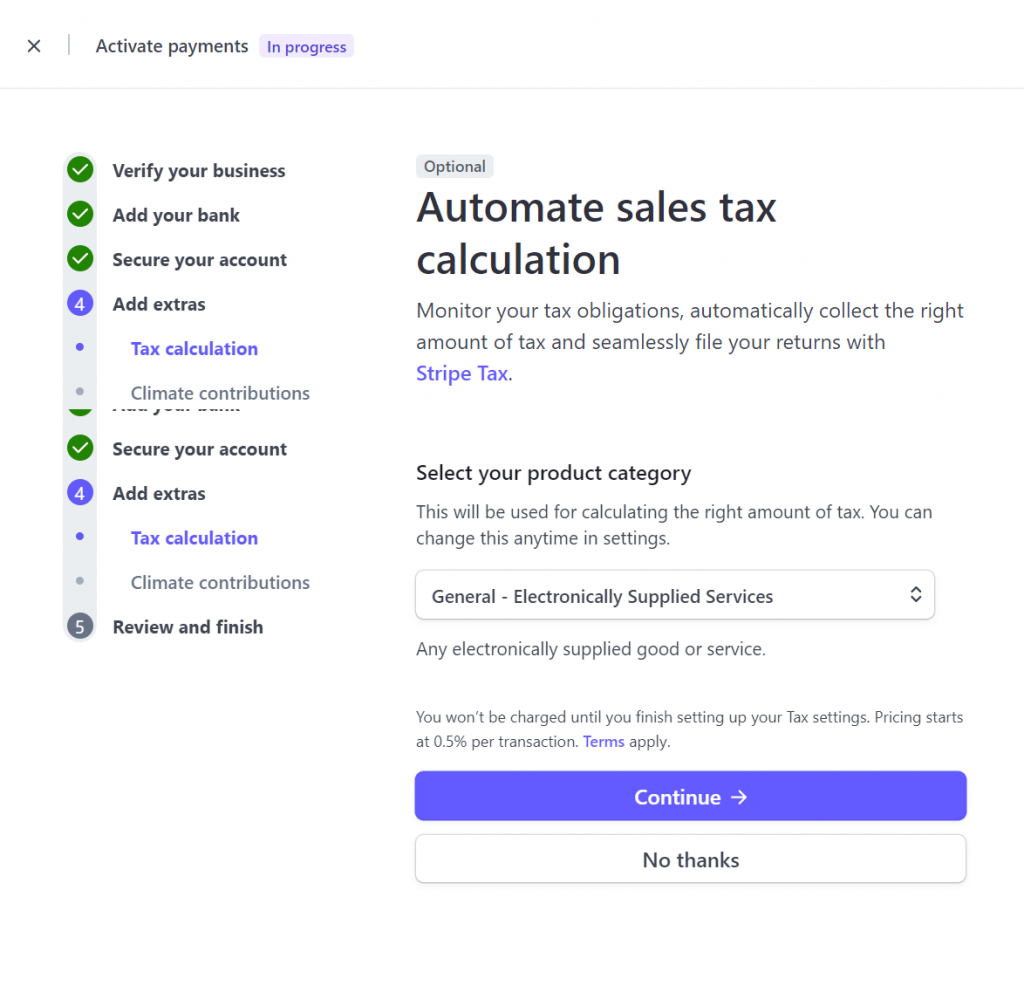

Step 11. Tax calculation. Click No thanks.

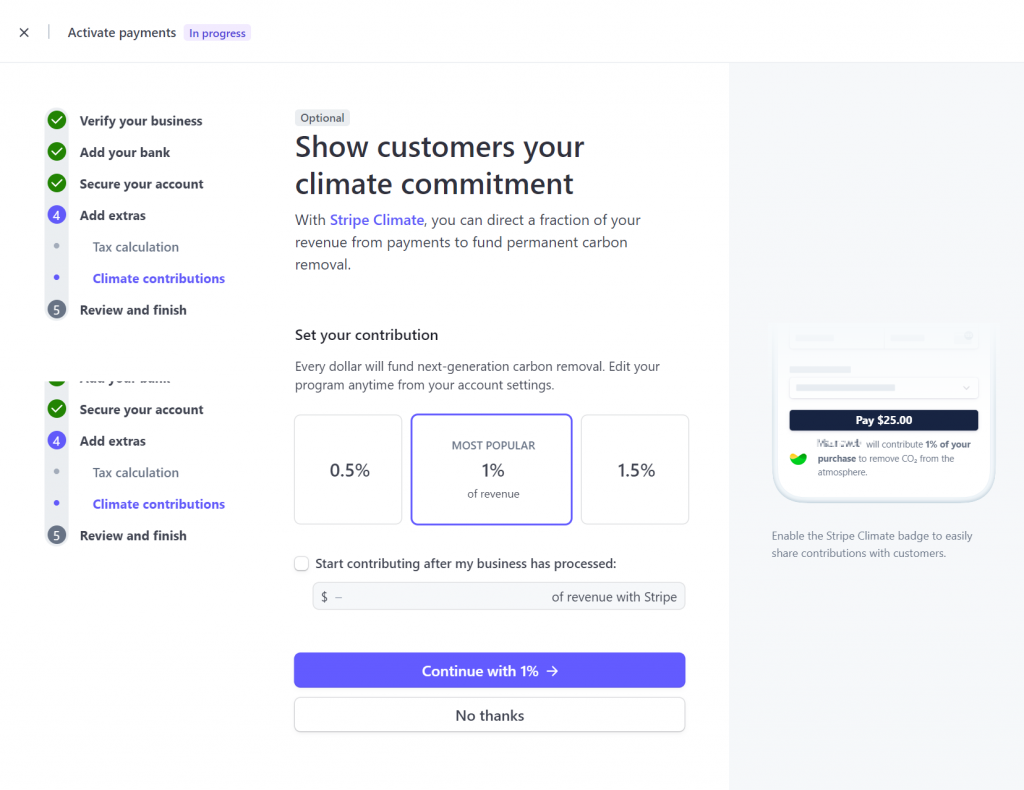

Step 12. Climate contributions. Ignore this part.

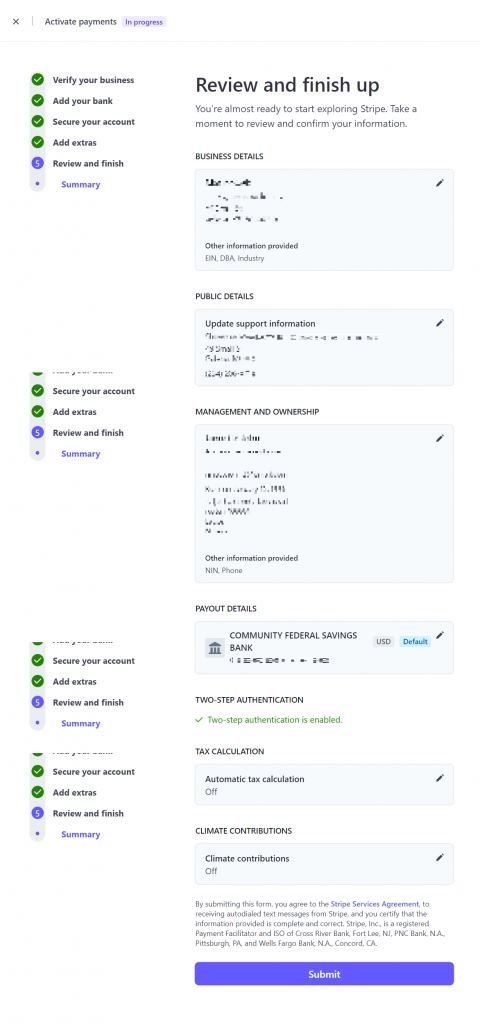

Step 13. Review and submit. Check to see that all details you have entered are correct. If all information is correct, click on submit.

Should I say finally? Maybe!

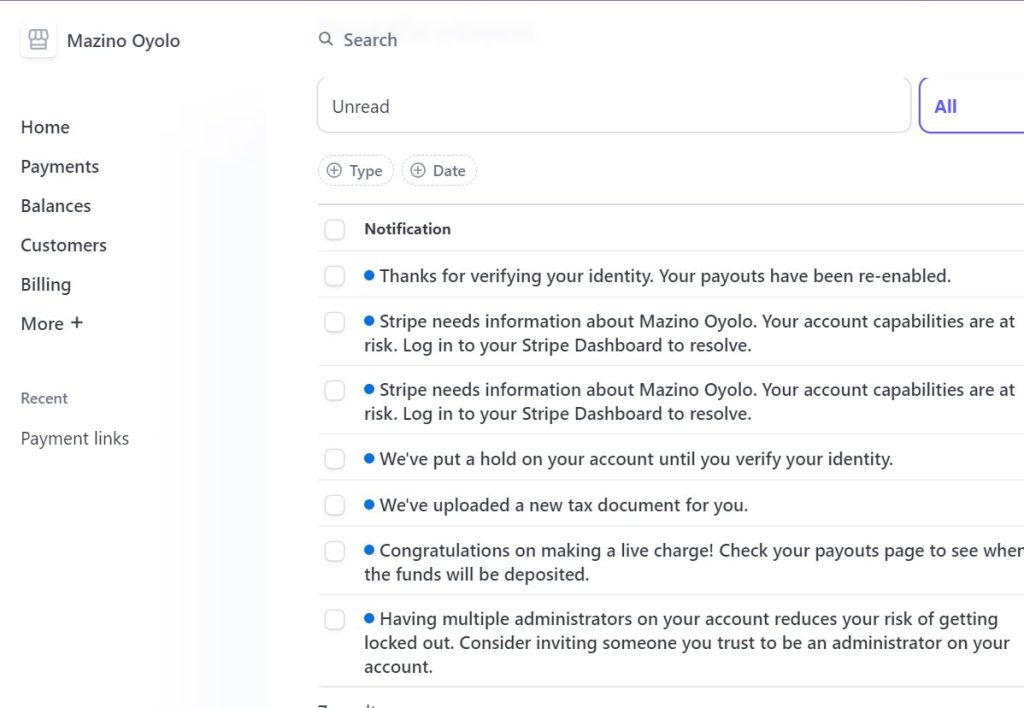

You need to check your email for any further information from Stripe. Sometimes they ask you for proof of certain details you submitted if they are finding it hard to verify the information.

If you follow this guide step by step, and you live in a country where Stripe is not supported, you should be able to start using Stripe legally. This method is accepted by Stripe. You won’t get banned by Stripe as long as your business is not restricted or prohibited.

Should I Buy A Stripe Account?

Don’t Buy a Stripe Account! Buying a Stripe account is strongly discouraged for several reasons. First, it violates Stripe’s terms of service, exposing you to legal consequences.

Purchased accounts may have been acquired fraudulently, putting you at risk of account suspension or frozen funds. Acquiring someone else’s Stripe account means inheriting their business history, which could include unresolved disputes, chargebacks, or financial liabilities.

It is crucial to establish your own legitimate Stripe account to ensure legal compliance, safeguard your reputation, and retain control over your business operations. By doing so, you can maintain transparency, trust, and accountability with your customers and partners.

thank you for the post one thing that is missing is info about the taxes, like income tax if you are not a citizen of the us, and you already pay income tax in your native country, would you have to pay both countries?

Whether you have to pay taxes in the US and your home country if you open an LLC in the US as a non-citizen depends on a number of factors, including:

1. The source of your income.

If your LLC generates income from sources within the US, such as sales of goods or services to US customers, you may be required to pay US taxes on that income. However, if your LLC’s income is from sources outside the US, you may not be required to pay US taxes on that income.

2. Your home country’s tax laws.

The tax laws of your home country may also affect whether you have to pay taxes on your LLC’s income. For example, if your home country has a tax treaty with the US, you may be able to claim a credit for taxes you pay to the US on your LLC’s income.

3. The structure of your LLC.

The structure of your LLC can also affect whether you have to pay taxes in the US and your home country. For example, if your LLC is a single-member LLC, you may be treated as a self-employed individual in the US and your home country, and you may have to pay taxes on your LLC’s income in both countries.

However, if your LLC is a multi-member LLC, you may be able to structure your LLC in a way that allows you to avoid paying taxes in one or both countries.

It is important to consult with a tax advisor to determine your specific tax obligations if you are considering opening an LLC in the US as a non-citizen.

Here are some general rules of thumb:

* If your LLC has no US presence or economic substance, you will not be required to pay US taxes on your LLC’s income.

* If your LLC has US presence or economic substance, you may be required to pay US taxes on your LLC’s income, even if the income is from sources outside the US.

* If your home country has a tax treaty with the US, you may be able to claim a credit for taxes you pay to the US on your LLC’s income.

It is important to note that these are just general rules of thumb, and your specific tax obligations may vary depending on the specific facts and circumstances of your situation. You should consult with a tax advisor to determine your specific tax obligations.

thank you Mazino, for the article and the replay.

my situation is, I am a video service provider for clients all over the world including the US

I am located outside the US in a country with a tax treaty with the US.

From the information that I gathered from the answer you gave me, I do not need to pay US taxes

Thank you so much for this useful article!

I live in Korea and want to ask if this would be possible if I do something similar by making a LLC in Singapore.

Will I be able to use all of the same Stripe features if I create a Singapore LLC and use my Korean bank account connected to Payoneer?

Thank you in advance!

I have no experience in creating LLC in Singapore for Stripe creation.

And if you are going to use Singapore details, it will mean you should a Singapore bank account and not a Korean bank account.

I hope this answer your question.

Hello,

I saw that Stripe is proposing an alternative called Stripe Atlas, is there any reason why we should follow the process you’re mentioning and not go for this option ?

Thank you

The choice is yours to make, but there are some reasons why many people don’t choose Stripe Atlas. One reason is that the cost is about $500, which can be less if you follow the method in this post.

Another reason is that you can’t decide the state to form your LLC. Stripe Atlas usually uses Delaware, and this state may not have a low annual tax return.

I hope this answers your question.

Thank you for the really quick answer.

Another question i have is when we follow you’re method or the Atlas method do they provide us a bank account in the US and in that case, do we have to use this bank account or we can use a foreign bank account ?

Thank you

Whatever method you choose, you won’t be given a US bank account. It is after your LLC has been formed, you can then use it to open a US business bank account.

Nevertheless, you can open get a US bank account when you sign up for Payoneer.

You can’t use another foreign bank account because you are opening a US Stripe account.

I hope this is very understandable?

Yes thank you very much.

Very good information. Especially bfor us non US citizens.

Is it legal to link the Stripe account to Shopify without the risk of getting it closed or suspended? I am doing dropshipping store but I am not sure if this method will serve my business without any risk

and thank you for your effort.

Some businesses considered as high risk to Stripe.

https://stripe.com/legal/restricted-businesses

Aside that, there is nothing illegal in using Stripe for a Shopify store. Just make sure what you are selling is not prohibited by Stripe.

Some businesses considered as high risk to Stripe.

https://stripe.com/legal/restricted-businesses

Aside that, there is nothing illegal in using Stripe for a Shopify store. Just make sure what you are selling is not prohibited by Stripe.

Hello Thanks for the information regarding the creation of the stripe account, But Please is there any other way to register the LLC without making payment and during the process of identity verification do I need to submit my NIN card or international passport for me to verify selfie.

If there is any other way of registering an LLC without paying, don’t you think it would have been revealed in this article?

I was never asked for selfie verification. However, Stripe may require selfie verification for some reasons. You can provide any of your government-issued IDs.

Hey! just wanted to ask as a foreigner applying for an LLC at incfile, how long did you wait until you finally got your EIN? does it come around the same time as your LLC files? (3 weeks)/2 weeks (expedited). Or does it take longer as the website suggests? “For foreign individuals, IRS does not offer an immediate obtainment of the EIN. The timeframe to obtain the EIN could take up to 3 or more months.”

You can speed up the process by directly contacting the IRS, the agency responsible for issuing EINs and providing other tax-related services.

You can receive your EIN over the phone by calling them. Ensure you have a copy of your SS-4 form, which IncFile (now Bizee) will send you. The IRS will ask a few questions based on the form, so it’s best to keep it easily accessible on your phone, computer, etc.

IncFile has already submitted your SS-4 form to the IRS, and they will use the details from it to locate your information.

Here’s the number to call: +12679411099 (use a US phone number to save calling cost).

When you call, follow the automated instructions to reach the EIN Customer Service department.

Sometimes, you might be redirected to a different number since there are various departments, but follow the prompts and they will provide your EIN over the phone.

Instead of waiting three months for your EIN after forming your LLC, you can start calling the IRS 5-7 days later.

Make sure your LLC is officially formed before starting this process.

I got your explanation to most of the questions but I didn’t get it from the situation that someone wants to open it just not for a business. Say , a freelancer. does it requires all those procedures or processes?

Additionally, how long will it take to acquire it?

I don’t understand your question that much. You must follow these procedures if you want to use Stripe from an unsupported country.

How long will it take to acquire what? The LLC or the Stripe account?

Thank you so much for this information.What about using UK account,,can I follow the same procedures??

Yes, but you will need to form a UK company. You can use this link for a UK company https://www.mazinooyolo.com/go/1stformations

Thank you. This is massive research compiled for the taking. Thank you.

I have made several failed attempts in receiving money with online programs. You have no idea how much this helps.

Two questions though.

1) What is the average processing time for the LLC?

2) Do you have any idea if the UK company will serve the same purpose of using stripe?

Thank You.

What is the average processing time for filing your LLC with the state? Well, it could 2 weeks, and obtaining your EIN can take more time.

If you are going to open a UK company, you should open a US stripe account and get other relevant UK documents.

I hope my reply was satisfactory, if not do let me know.

Thank you for this amazing video (especially liked the voice ;-)). However I have some more questions.

1. Can the LLC be an anonymous LLC?

2. Can the LLC be owned by a foreign LLC?

3. can the LLC have multiple owners and if yes can one of the owners be a foreign LLC

Thanks in advance

Chris

In response to your questions:

1. The LLC can be anonymous, if you choose a state such Wyoming

2. I will need do further research on that

3. This applies to 2.

Is it still applicable?

Yes